Historically, it’s only been possible for a business to share information directly with a customer or supplier - that’s all technology and our trust comfort levels have enabled.

But what if growing our business meant expanding our relationship to the client of our client, or the provider of our provider in a ‘safe’ way? What if through blockchain we could build relationships with organisations that we don’t know directly, or moreover, the types of third parties that require extra validation, like customs authorities or banks?

Network generated trust

This is where the greatest business potential of blockchain can be found. The emerging technology provides trust in the very foundations of how it has been developed - network generated trust. Blockchain is a tool that allows us to build relationships with others, based on this inherent trust. Innovation thought leader Don Tapscott calls blockchain "The Trust Protocol”, as trust is native to this technology.

This technology allows transactions and information stored in the blockchain to be trusted not only by those participating, but also by other third parties. In our previous blog post as part of this series, we discussed how Maersk and IBM have been trying to solve the lengthy freight paper trail, by trialling blockchain to ship flowers to Holland from Kenya, oranges from California, and pineapples from Colombia, all in an effort to validate a blockchain solution for shipments coming into the Port of Rotterdam.

As the Maersk/IBM case study demonstrates, this digital innovation has huge potential and can be used to solve a broad spectrum of real-life business problems.

In this final post of this three part blockchain blog series, I will explore how this technology could be used most effectively in the supply chain business and also dispel some common myths. Let’s quickly start from the beginning - so you can see how this solution has evolved to its present day potential.

Refresher

In 2008, Satoshi Nakamoto published a paper about a technology used to create a cryptocurrency, called Bitcoin. The underlying technology, blockchain, allowed people to carry out peer-to-peer transactions based on the trust provided by this protocol, without any other intermediaries.

For the first time, blockchain meant we had ownership and transaction records in a decentralised, public, immutable, and highly reliable database. The technology was built with a clever use of cryptography and a network that collaborates and competes at the same time. However, despite it's mainstream popularity, the Bitcoin currency is actually just one type of asset that can be registered in this database. Cars, houses and gold can also be stored - your imagination is the only limit. This storage is achieved using tokens - digital symbols serving as a representation of an asset. In the words of Sally Davies, The Financial Times technology reporter, “[Blockchain] is to Bitcoin, what the internet is to email. A big electronic system, on top of which you can build applications. Currency is just one.”

Smart Contracts

Still in its infancy, this technology has already gone through its first revolution, with the appearance of Smart Contracts. The revolutionary implementation of Smart Contracts added intelligence to a simple records book. Now, trust has been expanded to actions. Implemented for the first time in the Ethereum blockchain, it provides contracts in which trustworthiness is enforced by the network.

Loan contracts are a good example to show what Smart Contracts has to offer. When using Smart Contracts any digital asset can be used as collateral. This allows us to verify its ownership, checking if the asset is used in another active transaction, and, in the case an execution is needed, it can be done automatically - no need for any intermediaries and associated long waiting times, or complicated procedures. This ability to have a direct transaction provides simplicity and confidence that the lender will get their money. This can push down interest rates and provide a fast way to get capital-on-demand.

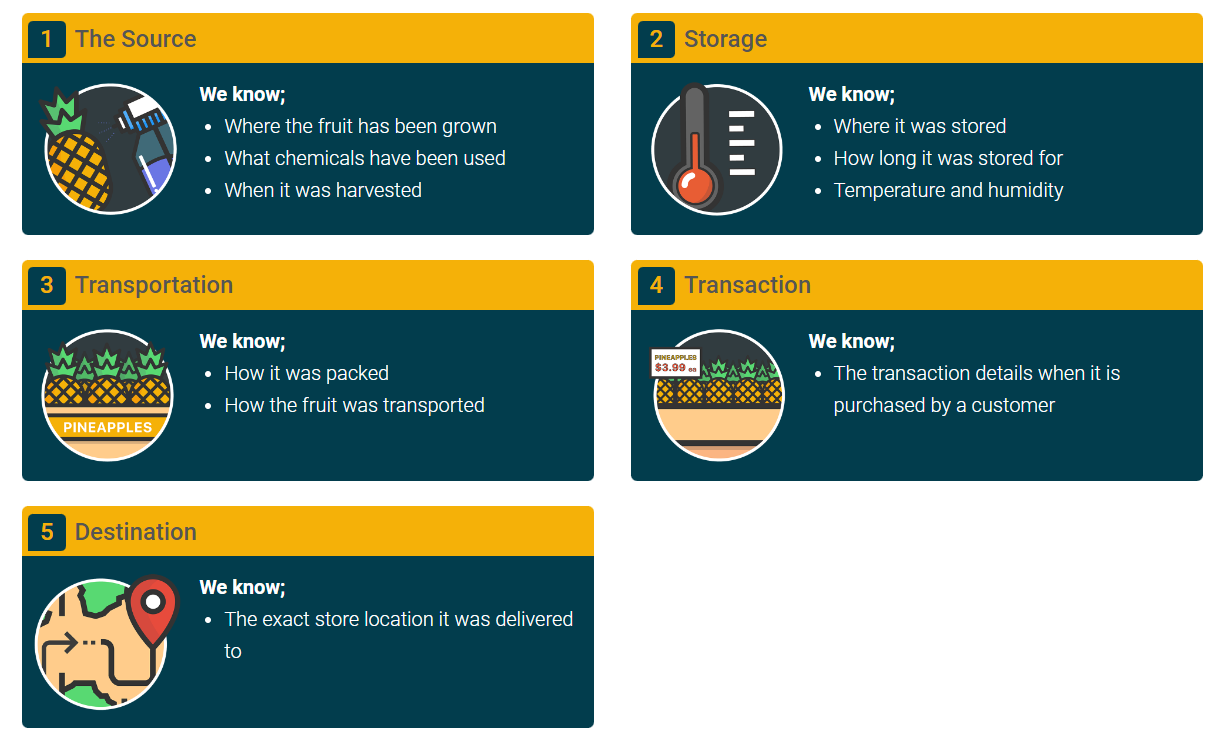

Traceability

A straightforward use of blockchain in supply chain businesses is to use it as a tool for traceability. In blockchain you can store the entire history of your products, meaning all relevant participants can provide the information generated during each stage of the product’s life cycle. See the below pineapple example:

Let's analyse a produce supply chain, fruit for example

We know;

- The exact store location it was delivered to

Using the above information, a customer can know the story of the product they are about to buy, and if that food product really comes from the high quality growing area it was marketed as being from. At the same time, the grocery store buyers can know how production was for that specific fruit and place an order based on trusted information. Moreover, other supply chain participants can benefit and increase the value of the blockchain, simply by providing more information. That fruit could be certified (or not) showing that is coming from a non-conflict zone, or if it was fair traded, or that it is non-GMO. Having increased traceability also helps to reduce waste - in the case of food diseases, the source of the the initial outbreak and therefore only all affected fruit can be traced, greatly reducing contamination and the risk of spreading the disease further.

A number of global companies have already identified the potential of blockchain and have begun working on traceability solutions in a variety of business situations:

- Walmart is already working on digitally tracking the movement of pork in China on a blockchain

- Cargill is testing blockchain to track the provenance of turkey products

- After the successful test with pork and a second test with mangoes, Walmart, Nestlé, Dole, Tyson Foods, Kroger, and others are partnering in a new food tracking program

- Also new and small companies are working on innovative solutions, as bringing transparency to the seafood and fish markets

Privacy concerns

As citizens of the world facing increasing threats to data privacy, you may be wondering if making data more accessible through blockchain could be risky. Companies still do not want to share all their internal data with the world. There are many ways to define the visibility of information on a blockchain. The information can be public, private, and with different levels of access. As in most of the systems, a security framework can be applied and it can define who, when and what data can be viewed. It is possible to give limited access to a person that lapses after a short period of time. A wide range of rules can be used to manage the access to the information. For example, the Maersk solution didn’t allow customers a view on shipment details.

Also, it is possible to consider a hybrid solution where part of the information is held privately but with a public signature (this provides the ability of validating its authenticity). In this way, all your data would remain in your organisation, but when an external entity needs to audit that information, it could be verified using a public record with a specific date certifying that the information has not been altered in any way.

You won’t be held hostage by tech companies

Companies trying this technology do not want to be hostages of the blockchain vendor they work with. This concern was understood from the beginning by the major players. Big companies like IBM and Microsoft, provide their solutions open source. One of the first initiatives of the first IBM blockchain team, as indicated by the NYT, was to make the technology open source. IBM was betting on making money by selling software and services that would sit on top of the technology.

In a situation where a company wanted to retrieve all their information from a blockchain and put it on a totally different one (or another technology), it’s important to remember that blockchain is a database, and the same rules apply. You can read your information and save it wherever you want. The transfer of data could be as simple as copying information from a big Microsoft Excel spreadsheet to Google Sheets.

Conclusion

The above examples and dispelling of myths demonstrate that blockchain-based solutions are worth considering. Blockchain provides secure but flexible platforms to transform and innovate how businesses face current and future challenges.

Through this three-part series, we have spawned a variety of thoughts and case studies held from the past three years as blockchain has evolved. By the end of 2017, accentuated by the high valuations of Bitcoin, there was a lot of hype around cryptocurrencies and blockchain. All this excitement is reminiscent of the dotcom bubble, a feeling shared by many. It’s important to differentiate the more popular cryptocurrencies and their underlying common technology, blockchain, as we have been doing during our series. Gartner, in its classic Hype Cycle still considers blockchain in the “Peak of Inflated Technologies”, supporting the idea of the high expectations behind this technology.

We believe that the digital innovation of blockchain has potential and could be used to solve a broad spectrum of real-life business problems. We support the notion that better communication will provide better business results.

Timing is crucial to get the maximum benefit from evolving technology. FedEx had to build one of the largest airfleets in the world to deliver their packages on time, but with the existing solutions out there, your company doesn’t need to go to such extreme lengths to improve its product delivery.

“Being too early is indistinguishable from being wrong” - Tim O’Reilly. Timing is key, taking risks and innovating your online sales platform at the right time could not only grow your sales but also give you an edge to become a giant akin to the likes of Amazon and Alibaba. Deciding on timing and priorities comes down to a number of factors: customer demand, cost versus benefit, and business resource available to invest both time and money. Maersk is a relatively early adopter of blockchain and would have weighed up these options. By taking a risk and investing early, could they be creating the standard international commerce platform of the future while improving their own logistics services?

To decide on the right timing and solution, companies need to carry out sincere analysis, weighting the effort and the gains of getting involved with Blockchain now, versus waiting or not using it at all ever. Some also believe depending on the business case, that a centralised database could provide a more effective solution than blockchain. From this analysis process, you may decide not to adopt blockchain right now, but will benefit from other technology solutions found by exploring new ideas and reviewing the established way of doing things. A good understanding of blockchain, its potential and risks, combined with your business knowledge will only further future proof your business.

Since 1989, Sandfield has been providing custom software solutions, witnessing many technological transformations, separating the wheat from the chaff. We understand your needs and know how to use technology to give you an edge over the rest. We’re ready for the challenge, so feel free to get in touch to discuss blockchain and any other innovative solutions with the Sandfield team today.